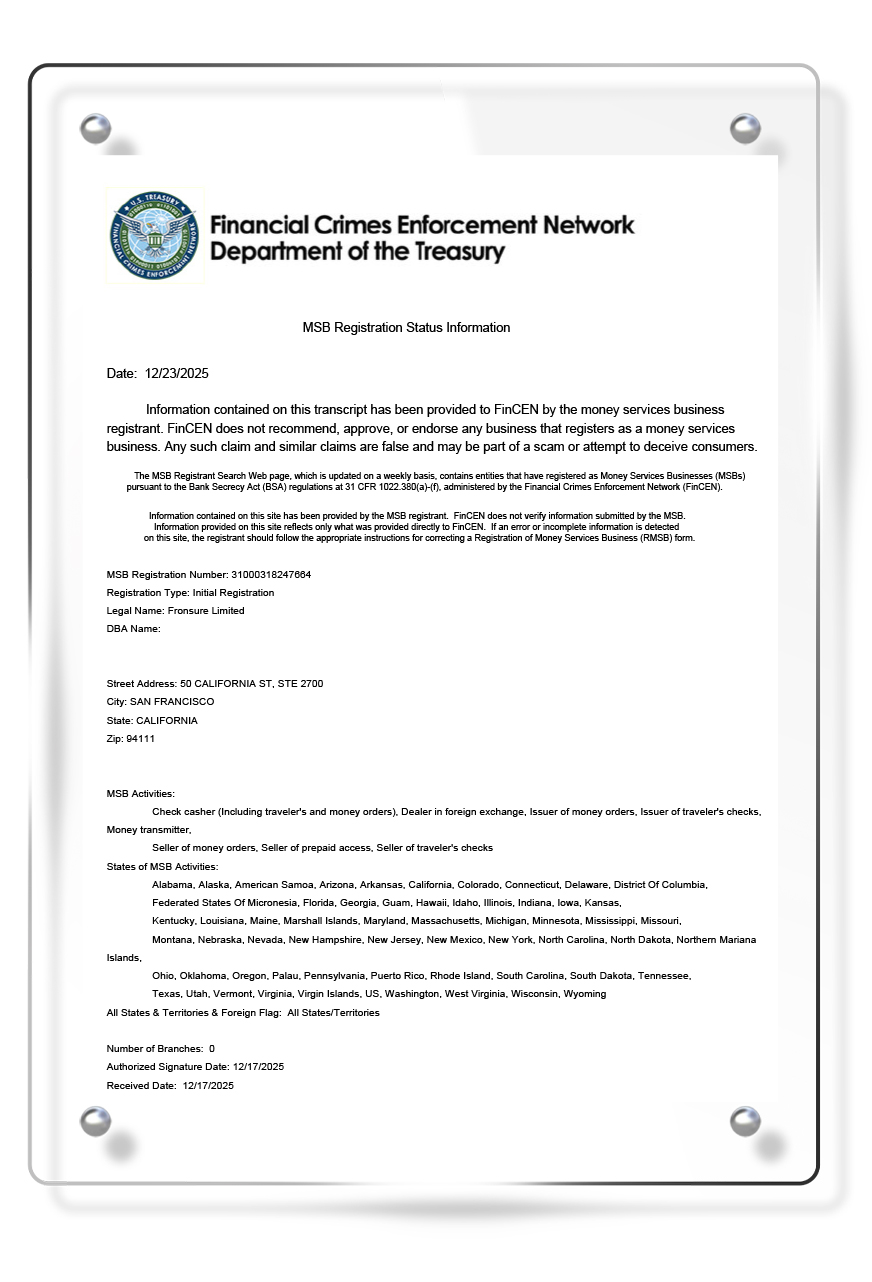

Founded in California in 2025, the company is a leading global provider of decentralized insurance infrastructure and is regulated by MSB Financial Services. With blockchain technology at its core, it restructures the insurance industry's "trust mechanism" and "service efficiency," creating a full-category insurance ecosystem adapted to both the digital economy and real-world scenarios.

A decentralized insurance protocol based on blockchain technology aims to solve the structural pain points of the traditional insurance industry by "codifying rules, making processes transparent, and automating execution," and to provide global users with a full range of risk protection services covering digital assets and physical scenarios.

Covering insurance solutions across all scenarios including digital assets, health travel, supply chain logistics, gold, crude oil, and renewable energy.

Maintaining the decentralized insurance platform's fund pool, claims mechanism, and ecosystem collaboration.

Promoting multi-regional regulatory compliance and expanding our global user and enterprise customer base.

Providing customized insurance API services and risk solutions for Web3 projects and traditional enterprises.

The entire process requires no manual review, and the rules are open and transparent.