Fronsure's reinsurance pool contains the protocol's own funds. Its returns come from three sources: DeFi yield generators, protocol fees, and a rewards pool. As an internal guarantee provider, the reinsurance pool can significantly reduce protocol risk without increasing the additional costs of regular guarantee providers.

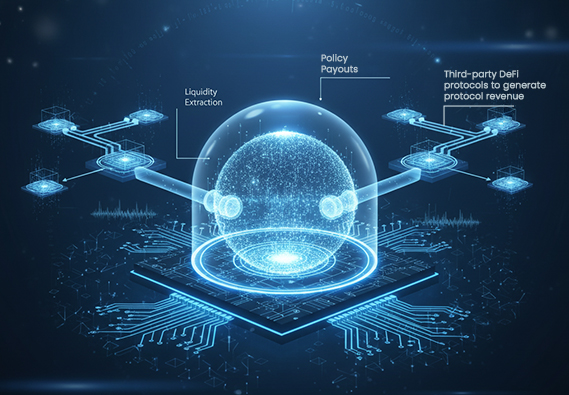

The platform's own liquidity pool manages and allocates internal and external funds. It handles liquidity withdrawals, policy payments, and investments in third-party DeFi protocols to generate protocol yield. Its "liquidity buffer" is rebalanced daily to ensure continuous operation and payments.